The Assessment department annually prepares, communicates and defends property and business assessments across Lac Ste. Anne County. Through fair and equitable assessments, the resulting property and business taxes support the essential municipal services provided to County residents and business owners.

Assessment & Taxation

Funding and facilitating essential County services

Assessment notices are mailed each year in May and are due June 30. Property and business owners should carefully review their notice and contact Assessment if they have any questions or would like more information.

If you did not receive your notice or have questions that have not been answered by the information in this section, please call the County administration office at 780.785.3411 (toll-free 1.866.880.5722) or email assessor (@) LSAC.ca.

Sources of County Revenue

Property and business taxes are key sources of revenue for the County. These taxes provide the County with the funds required to deliver the many day-to-day services and programs that citizens need, want and deserve, such as:

-

Road construction and infrastructure maintenance

-

Parks, leisure facilities and programs

-

Enhanced fire and emergency services

-

Numerous other community-focused initiatives

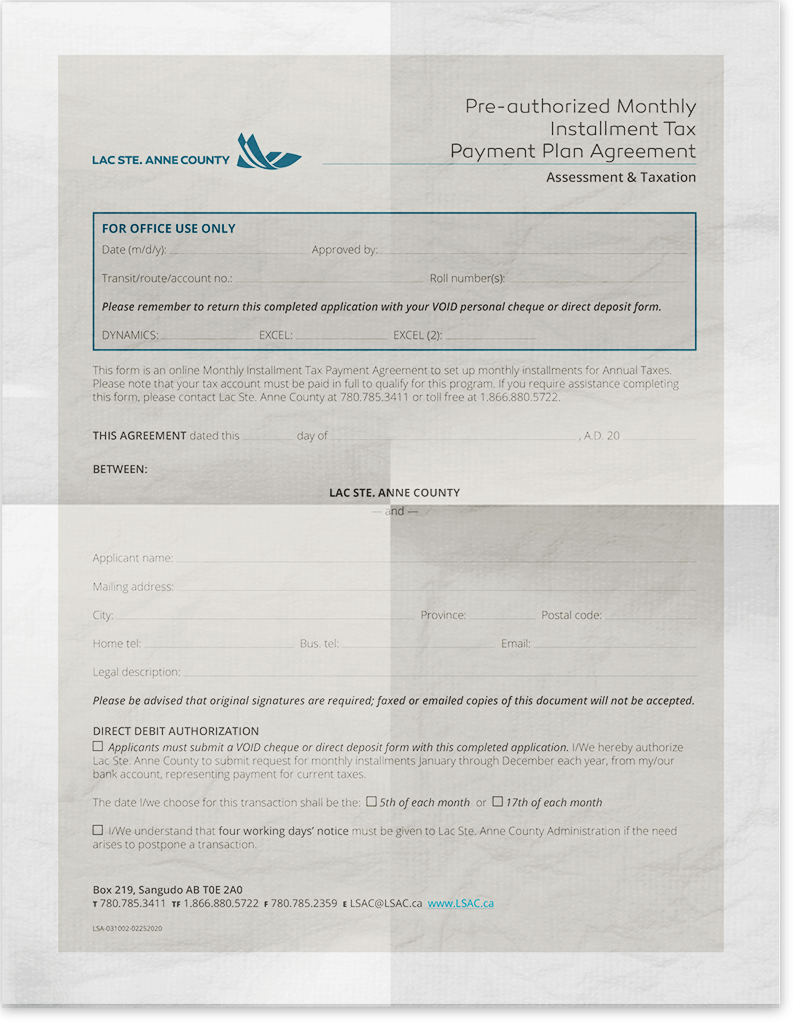

Document Library

FORM DOWNLOADS

This is certification under Sections 310(4) & 336(1) of the Municipal Government Act that Combined Assessment and Tax Notices were mailed to all property owners in Lac Ste. Anne County on Friday, May 5, 2023.

Notice of Preparation of Assessment Roll and Mailing of Assessment Notices

Notice is hereby given that the Assessment Roll of Lac Ste. Anne County, made under the provisions of the Municipal Government Act, Statutes of Alberta, 2000, Chapter M-26 as amended, has been prepared, and the assessment notices were mailed out on May 5, 2023. The roll is open to inspection Here on the County website. Any person who wishes to make a complaint must submit the complaint on or before Friday, July 14, 2023 via the prescribed complaint form available Here on the County website.

There is no right to make a complaint about any tax rate. Information outlining the rules and regulations and information concerning assessment complaints is also included on the reverse of your Tax and Assessment Notice.

Mike Primeau, County Manager

Lac Ste. Anne County

Box 219 Sangudo, AB T0E 2A0

Dated this 8th day of May, 2023

*Note that your property assessment is included on the tax notice for your property.